There’s a lot tools for converting from salary to hourly wage available on the internet, but most of them are fairly limited. I created a more advanced one:

A link to the spreadsheet is below the fold.

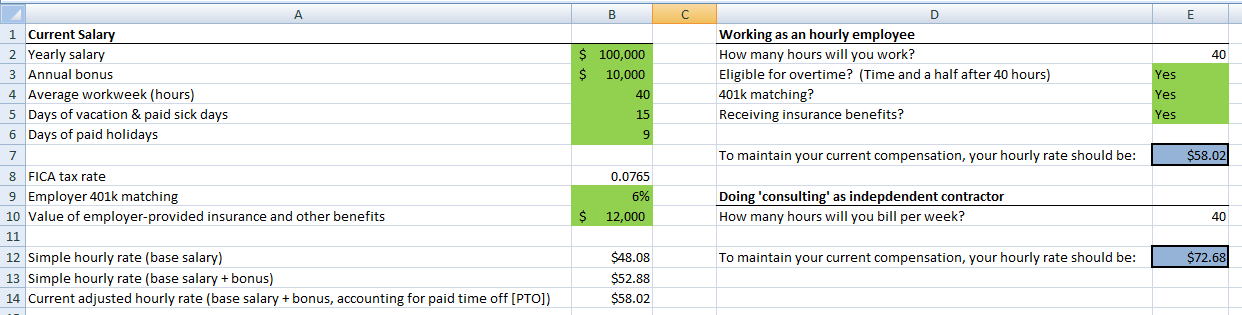

The Problem: there are a number of free salary to hourly converters, but they they’re all overly simple, and don’t tell you your true compensation. This example, for instance, takes compensation, divides it by 52 weeks and 40 hours per week.

What’s Missing:

– On a salary, if you get Paid Time Off [PTO], you’re getting paid even though you don’t work on holidays, sick days, and vacation days. More PTO increases your effective salary.

– Salary is only one piece of total compensation – some workers get additional compensation in the form of bonuses, 401(k) matching, and health insurance benefits not available to individuals (value estimated at $12,000 per family, or $5,000 per person)

– Contractors pay an extra 7.65% of their salary in self-employment (FICA) taxes.

– When going from working on a salary to working on an hourly basis, your number of hours worked and overtime eligibility changes.

My Solution: I put together an Excel worksheet that address each of these problems. Fill in the green boxes, and the spreadsheet tells you how much you to make hourly as either an hourly employee or independent contractor to be equivalent to your current salary.

Drop me a line if there are any features I’m missing.